29+ is a heloc a second mortgage

Ad Apply for the Best Home Equity Loan With Our Exclusive Rates See Offers from Top Lenders. Qualification requirements vary by lender but generally follow these guidelines.

The Benefits And Risks Of A Second Mortgage Myhorizon

A HELOC can make money available to you only when you need it.

. Web The second type is a Home Equity Line of Credit HELOC. Proof of sufficient income. Youll need to follow these steps.

With a second mortgage youre sent the. Web A HELOC is a credit linemuch like a credit cardwith variable interest rates and you only owe what you draw from it. Web A second mortgage is similar in some respects to a HELOC as they use your homes equity as collateral.

Check Out the Best Lenders. Home Equity Loan Alternative. Ad 5 Best HELOC Loans Compared Reviewed.

Put Your Home Equity To Work Pay For Big Expenses. Web So if you still owe 200000 on your primary mortgage that means you can borrow only 55000 for a home equity loan or HELOC. The repayment period for a second mortgage generally ranges from five to 10 years while the repayment period for a.

Skip The Bank Save. The primary difference is how you receive the payment of. Find Out How Much You Could Be Paying Now.

If you need less. You can draw from a home equity line of credit and repay all or some of. No additional draws have been made against the HELOCsecond mortgage.

Web A HELOC is a line of credit so you can decide how much to borrow over time while a second mortgage is a one-time loan. Get Pre Approved In 24hrs. Apply For Home Equity Loan And Enjoy Low Rates.

Web 5 steps for refinancing your second mortgage. A 5year 10000 loan with 999 APR has 60 scheduled monthly. Ad Precise Monthly Payment Calculations.

Web Home Equity Loan vs. A HELOC however is not a lump sum of money. Web A home equity loan is a traditional principal-plus-interest payment and theres no ability to draw from it.

Which Option Is Right For You. Apply Online Get Pre Approved In 24hrs. Ad Precise Monthly Payment Calculations.

Find Out How Much You Could Be Paying Now. Web You need a minimum 700 FICO score and a minimum individual annual income of 100000 to qualify for our lowest APR. Lenders face higher default rates on second mortgages.

Web HELs like HELOCs will come with a higher interest rate compared to a cash-out refi. Web A home equity loan and HELOC allow you to borrow against the equity in your home and they function differently than a traditional mortgage. 255000 200000 55000.

Refinancing a second mortgage is a lot like refinancing any other loan. In exchange the lender gets a second. Like a home equity loan its secured by the.

Get Pre Approved In 24hrs. Use Our Comparison Site Find Out Which Lender Suits You The Best. If you were buying the home above with a fixed rate home equity.

Retain at least 15-20 equity in your home after the HELOC. Web A second mortgage loan is paid to you in a lump sum at the start of the loan. Ad 5 Best HELOC Loans Compared Reviewed.

It works like a credit card that can be repeatedly used. Web A home equity line of credit or HELOC is a second mortgage that gives you access to cash based on the value of your home. Ad Now That Rates Have Dropped on November 10th See About Tapping Into Your Home Equity.

Web HELOC requirements are based on your monthly income and debts credit score employment history and home equity. Apply Easily Get Pre Approved In a Minute. Apply Online Get Pre Approved In 24hrs.

Why Not Borrow from Yourself. Ad Todays 10 Best Second Mortgage Rates. Apply For Home Equity Loan And Enjoy Low Rates.

This type of second mortgage is similar to a credit card. Web When you take out a home equity loan your second mortgage provider gives you a percentage of your equity in cash. Web Using a second mortgage most lenders will let you borrow up to 85 of a propertys valueso you apply for a second mortgage.

Save Time and Choose the Right Home Equity Offer for You. A home equity line of credit or HELOC is another type of second mortgage loan. Web A mortgage will have a lower interest rate than a home equity loan or a HELOC as a mortgage holds the first priority on repayment in the event of a default and.

Web The HELOC or home equity loan was used to purchase the property. Because you bought your house. Web A home equity line of credit HELOC is a type of second mortgage as is a home equity loan.

Also second mortgage loans. Web For example if a home appraises for 100000 a home equity loan for 25000 would equal 25 percent of the property value. Usage HELOCs are issued with revolving terms and.

You have a total line amount and you can borrow up to that.

Heloc Vs Second Mortgage What S The Difference

:max_bytes(150000):strip_icc()/GettyImages-659856955-69e0090a55ee4f84b2c4d32fcc7c18ef.jpg)

Heloc Vs Second Mortgage What S The Difference

Should You Get A Heloc 2nd Mortgage Or Do A Consumer Proposal To Deal With Debt Youtube

How To Save Thousands On Interest With A Heloc Natali Morris

Second Mortgage Vs Home Equity Loan Which Is Better Us Lending Co

5400 Pleasant Creek Rd Rogue River Or 97537 Mls 220157024 Zillow

Home Equity Line Of Credit Qualification Calculator

Second Mortgage Vs Home Equity Loan Moneytips

Need A Loan If You Re A Homeowner Here S Why You Should Consider A Heloc Money Under 30

Second Mortgage Vs Home Equity Loan Moneytips

Second Mortgage Vs Heloc What S The Difference Westchester Mortgage

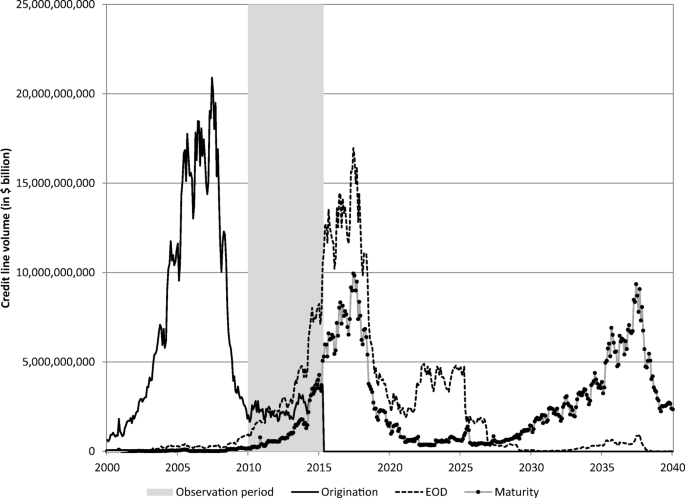

Positive Payment Shocks Liquidity And Refinance Constraints And Default Risk Of Home Equity Lines Of Credit At End Of Draw Springerlink

:max_bytes(150000):strip_icc()/GettyImages-1168467813-a72114bbb43849b4a305df0977cc2374.jpg)

Heloc Vs Second Mortgage What S The Difference

5434 Chaplins Landing Rd Hollywood Sc 29449 Mls 22004770 Zillow

How A Heloc Works Tap Your Home Equity For Cash

Second Mortgage Vs Home Equity Loan Which Is Better

:max_bytes(150000):strip_icc()/shutterstock_188743595.home.equity.loan.cropped-5bfc30d1c9e77c0026b5f52e.jpg)

Home Equity Loan Vs Heloc What S The Difference